Preliminary Information

Chapter 1: Introduction and Registration

- Introduction

- Registration Process

Chapter 2: Understanding Taxes

- Tax Fundamentals

- Deductions and Expenses

- Small Business Regulations

- Tax Planning Resources

Chapter 3: Accounting Essentials

- Income-Expense Accounting (EÜR)

- Invoicing Guidelines

- Annual Reporting Requirements

Chapter 4: Digital Tools and Resources

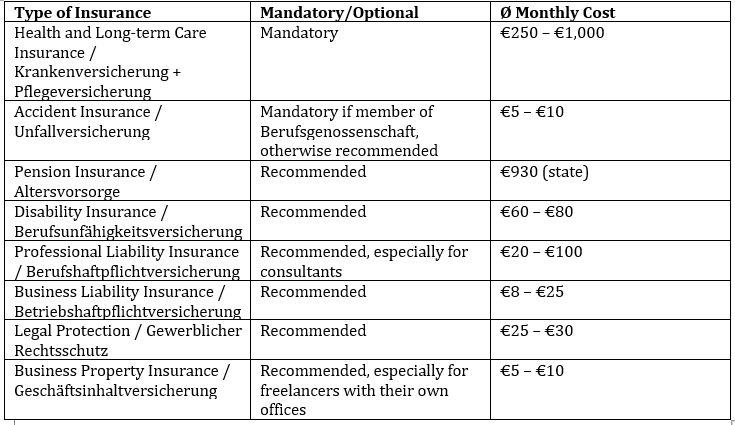

Chapter 5: Insurance and Protection

Chapter 6: Business Development

- Work

- Support Systems

- Contract Management

Chapter 7: Part-Time Self-Employment

Chapter 8: Conclusion

Preface

Freelancing in Germany is a diverse and flexible path that can be the perfect solution for those who value freedom of choice, autonomy and control over their work schedule. However, each step towards freelancing is a personal choice that depends on many factors: your character, professional skills, and the current situation in the labor market.

Some people like to work alone, take responsibility for projects, and manage time on their own. Others need a more stable schedule and a guaranteed flow of tasks from regular customers. It is important to understand that freelancing is not just freedom from office routines, but also responsibility for all aspects of running your own business: from finding clients and concluding contracts to complying with tax and legal regulations.

Freelancing in Germany is subject to certain rules, whether it is registering as a freelancer (Freie Berufe) or as an entrepreneur (Gewerbetreibende). Each of these paths has its own characteristics and bureaucratic nuances that require attention. This transition can be both inspiring and challenging, especially if you are not prepared for the complexity of administrative processes, tax obligations, and constant self-management.

However, with the right approach and proper preparation, freelancing in Germany can be the key to professional freedom and development. This is a path that opens up new opportunities for growth, but requires a clear understanding of all its aspects and a willingness to constantly improve yourself.

“Do I need it at all?” – you think in the pauses between orders. After all, every German accountant is so happy to help you fill out a declaration for a modest 200 euros per hour (yes, as if you don’t have any!). And when the client says that he would like to “pause for a month with payment”, you suddenly realize: all these risks now lie with you. No sick leaves, vacations or 13th salary. Just you, your computer, and… your taxes.

So, do you need it? If you like adventure, the German language and bureaucracy – yes, of course! And if not, then maybe it is worth reconsidering dreams of freedom and staying in a comfortable role as a full-time employee.

About The Author

Hi! My name is Ilya Fedotov and I have been living in Germany for more than six years, where I have been working full-time freelancer in the IT field for the past two years. With more than 20 years of experience as a Microsoft Solution Architect, I have been involved in major IT infrastructure migration and implementation projects for international companies such as Deutsche Bank, Fujitsu Services and Infosys. From registration to annual report and customer search. My information is based on my experience as a freelancer in Germany and will help you avoid common mistakes on your way to independence. But I warn you right away: I am not a financial guru or an accountant, so everything you do based on this text is at your own risk. Well, you know, the standard “I warned you”. 😊

I will make a reservation right away: this text will not contain long explanations about obtaining a freelancer visa. You need to go through this step yourself before you can register as a freelancer in Germany. And yes, this is just the beginning of the fun!

I will be glad to hear your comments and wishes about this manual. You can always contact me by email fedotov.ilya (at) gmail.com or via LinkedIn https://www.linkedin.com/in/fedotovi/.

Changelog

| Name of the change | Page | Date | Comments | Author |

| European Small Business Scheme с 2025 | 32 | 08.01.2025 | Innovations 2025 | Ilya |

| E-invoicing obligation | 42 | 08.01.2025 | Innovations 2025 | Ilya |

| New small business regulation 2025 | Full document | 08.01.2025 | Innovations 2025 | Ilya |

| Relief for the 2025 VAT return | Full document | 08.01.2025 | Innovations 2025 | Ilya |

| Increase in the basic tax-free allowance | Full document | 08.01.2025 | Innovations 2025 | Ilya |

| Document update, revision 4 | Full document | 19.01.2025 | Ilya | |

| Document update, revision 2 | Full document | 19.09.2024 | Ilya | |

| Document update, revision 2 | Full document | 15.09.2024 | Ilya | |

| Document Update, Revision 1 | Full document | 13.09.2024 | Ilya | |

| Creating a Document | Full document | 10.09.2024 | Ilya |

Chapter 1. Introduction

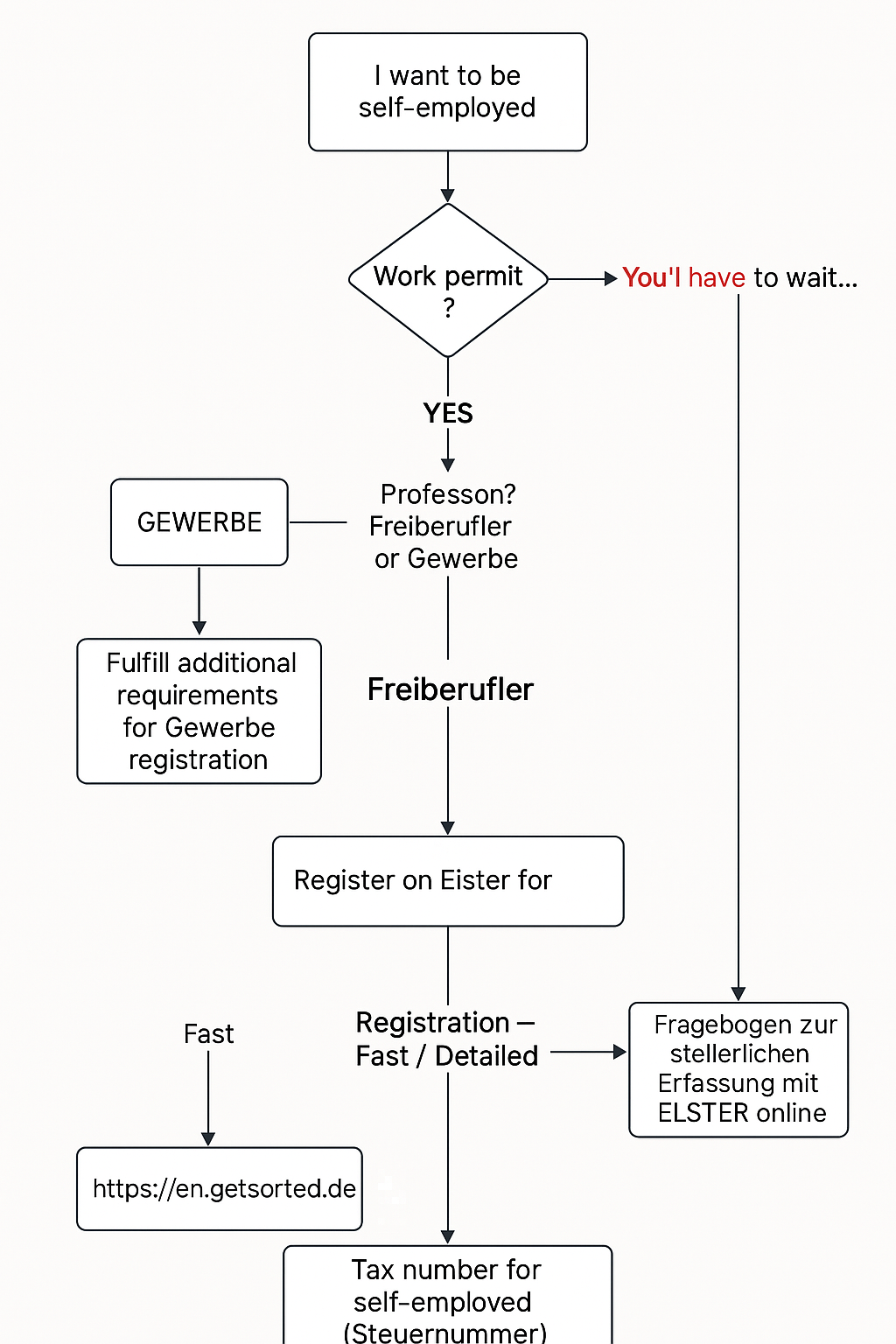

The general scheme of the registration process looks something like this:

Who are the freelancers and owners of Gewerbe in Germany?

In Germany, any activity must be clearly defined and classified, even if it is a matter of independent work. There are two main categories in this system: freelancers (Freiberufler) and Gewerbe owners. Each of these categories has its own unique features and requirements governed by German law.

Freelancer(Freiberufler)

A freelancer in Germany is a specialist who provides professional services that are not related to trade or commerce. The main requirement is that the activity must be intellectual and require special knowledge. Such professions include doctors, lawyers, consultants, programmers and other specialists. However, not every independent job falls under the category of freelancer. The activity must be sufficiently intellectual for German law to recognize it as such. For example, simply fixing computers does not belong here.

Freelancers are exempt from registration in the Handelsregister and from mandatory membership in the Chamber of Industry and Commerce (IHK), which greatly simplifies bureaucratic procedures. However, it should be borne in mind that not every activity can be recognized as freelancing. If you want to find out if you can become a Freiberufler, check the requirements on the IHK website: https://www.ihk.de/emden/recht/gewerberecht/abgrenzung-gewerbe-und-freier-beruf-2353148

Gewerbe (Own Business Owners)

If your activity does not fall under the category of “intellectual” according to government standards, then you become the owner of Gewerbe. Imagine a classic scenario: you open a store, start selling goods or provide services such as repairing equipment, and thereby become an entrepreneur. This sounds impressive, but it requires additional effort: you need to register with the trade register, pay trade tax, and be prepared to interact with the German bureaucracy.

Gewerbe owners have their advantages. First, you have the opportunity to expand your operations, hire employees, and even attract investments. However, by choosing this path, you become an entrepreneur and not a “freelance artist” as is the case with a freelancer. If your goal is to scale your business and achieve serious growth, then the Gewerbe owner journey is for you.

So who to be? If you’re looking for freedom and flexibility (with certain tax obligations), freelancing status may be the perfect choice. However, if you have ambitions to build and grow your business, then the world of Gewerbe can open up new opportunities for you.

Main Differences Between Freelancer and Gewerbe Owner

One of the key differences is, of course, taxation. The owner of a Gewerbe is required to pay a trade tax (Gewerbesteuer), which adds its share of bureaucratic responsibilities and financial obligations. While freelancers are exempt from paying this tax. It seems that the legislator said: “Okay, here is at least one relaxation for you, but do not relax!

The bureaucratic features do not end there. Freelancers get another advantage — a more simplified reporting and accounting system. They don’t have to spend long nights with a calculator and spreadsheets. Freelancers’ reports and tax returns in Germany say, “We’ll make it easy for you, but you still have to work hard.” This is a kind of “hardcore” mode of doing business.

It is important to remember that the Gewerbe registration process can vary significantly depending on the specifics of your business. Therefore, if you decide to immerse yourself in this world, you should carefully read the information and recommendations on this issue:

https://www.lexoffice.de/wissenswelt/selbstaendig-machen/gewerbe-anmelden/

https://www.ihk.de/karlsruhe/fachthemen/recht/gewerberecht/gewerbeanmeldung-4632354

So, if you’re looking for control and ready for the complexities of reporting, the world of Gewerbe may be your choice. And if you prefer an easier route, but with some “poignant” moments, freelancing is probably more suitable for you.

Elster Registration

!! One of the fundamental requirements for starting the whole process is access to the personal account of the financial service – Finanzamt. Through this account, you can apply for freelancing, officially communicate with Finanzamt, file tax returns, and also delegate access to Steuerberater. Detailed instructions are given below..!!

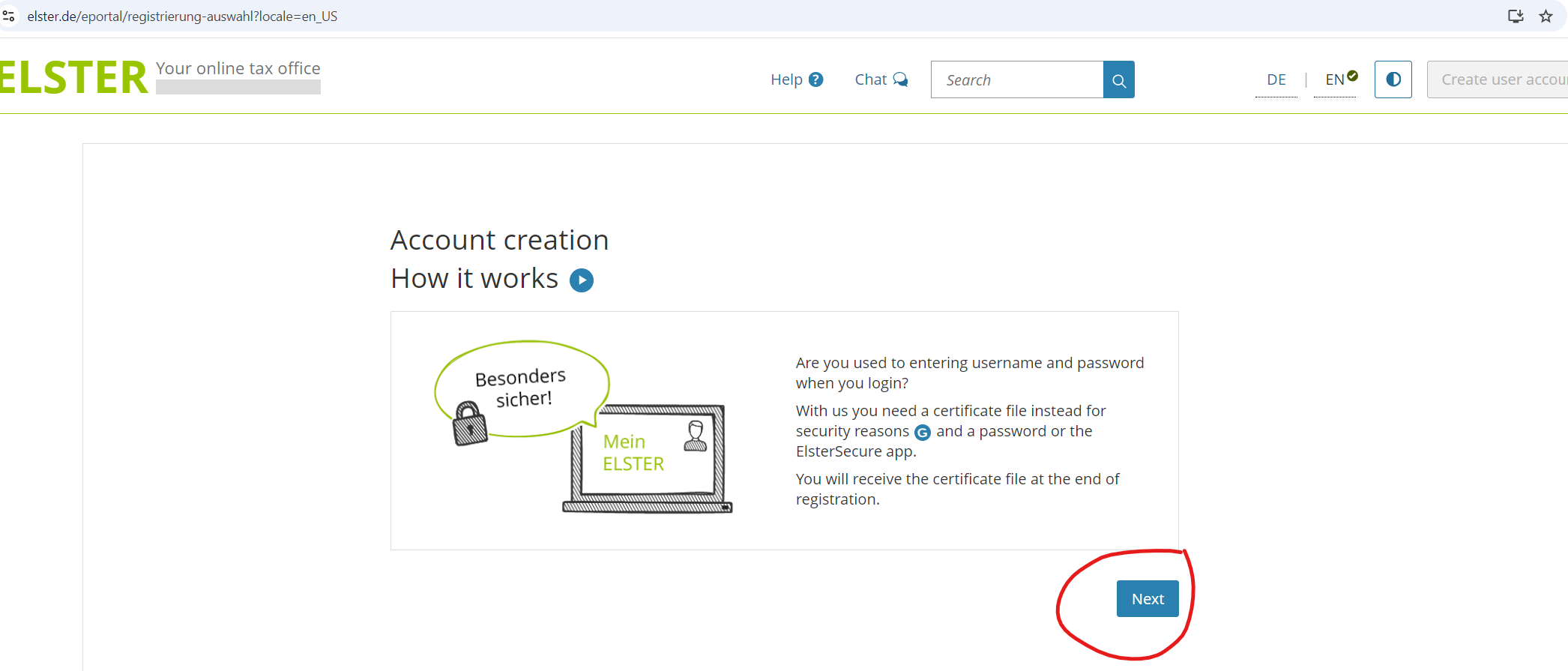

- Go to the https://www.elster.de/eportal/registrierung-auswahl?locale=en_US

- Click Next

- Click Next

- Select the Certificate file section and click Select

- Select For me ( and my parther) CNext

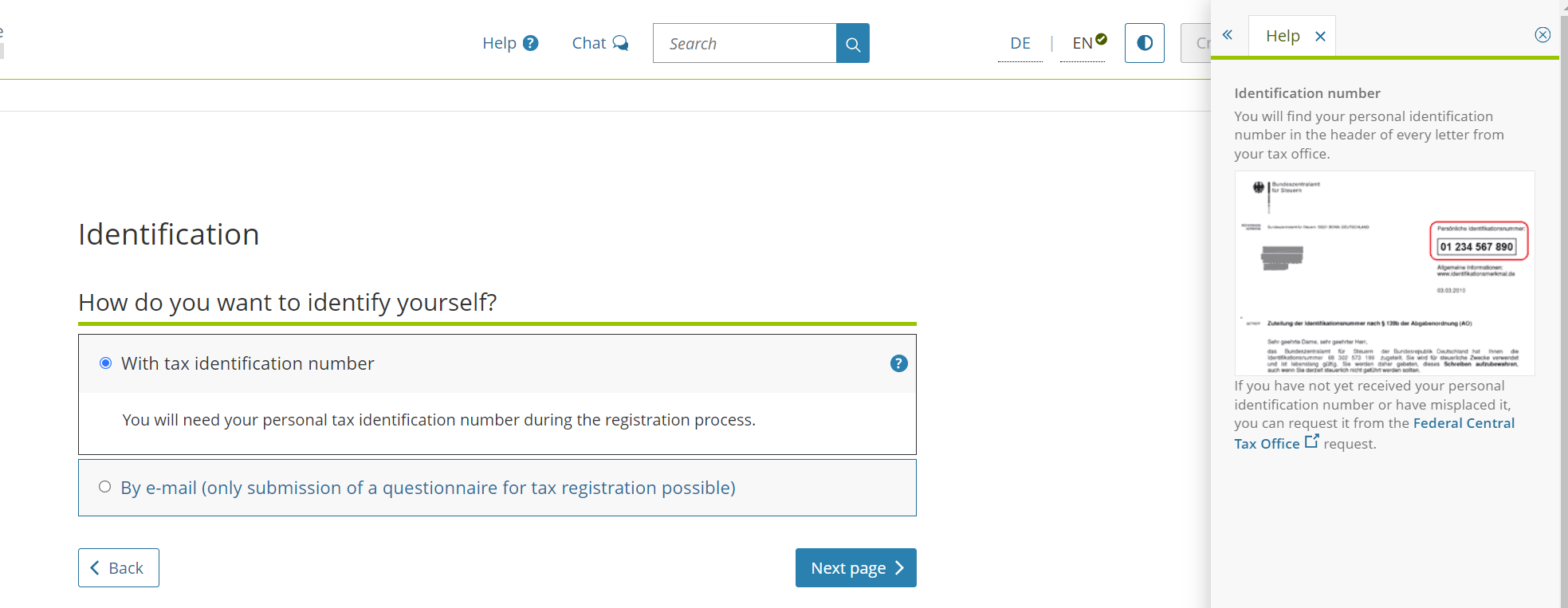

- Select With tax identification number

- Enter your data in the Data Entry section and check the box at the bottom (I confirm), click Next

- Fill Pre-filling the income tax return :

If you want to share the same account with your spouse or children, you can add their tax identification numbers here. Elster stores the details you provide on your tax return and automatically fills out basic forms for the following year, for example. If your data changes by then, you can of course edit it. Either way, it will save you time and allow you to see what data you have submitted in previous years. Now that you have entered all the required data, you can click on the “Check” button to review it again before sending.

- Confirmation of registration

If you have entered all the data correctly (marked in gray), click the “Submit” button. After that, you will receive an email to confirm the entered data. Click on the activation link provided in the email. If you don’t receive the email, wait a while and check your spam folder as well. The link is valid for seven days. You will then receive another email with instructions on how to activate your account and an important identification number (Activation ID) that you need to keep.

- Elster Online Registration

As soon as you receive an email with your second personal activation code, follow the next steps of registration. The letter should arrive within 14 days. If you do not receive it, please contact ELSTER customer service.

In the future, to access your personal account, you will need a certificate that you saved during registration + login and password

An important prerequisite before starting the registration process is to have a separate account/IBAN that you will use to generate income, pay taxes, and all possible expenses related to self-employment. Section 6. Banks

Freelancer Quick Check-In

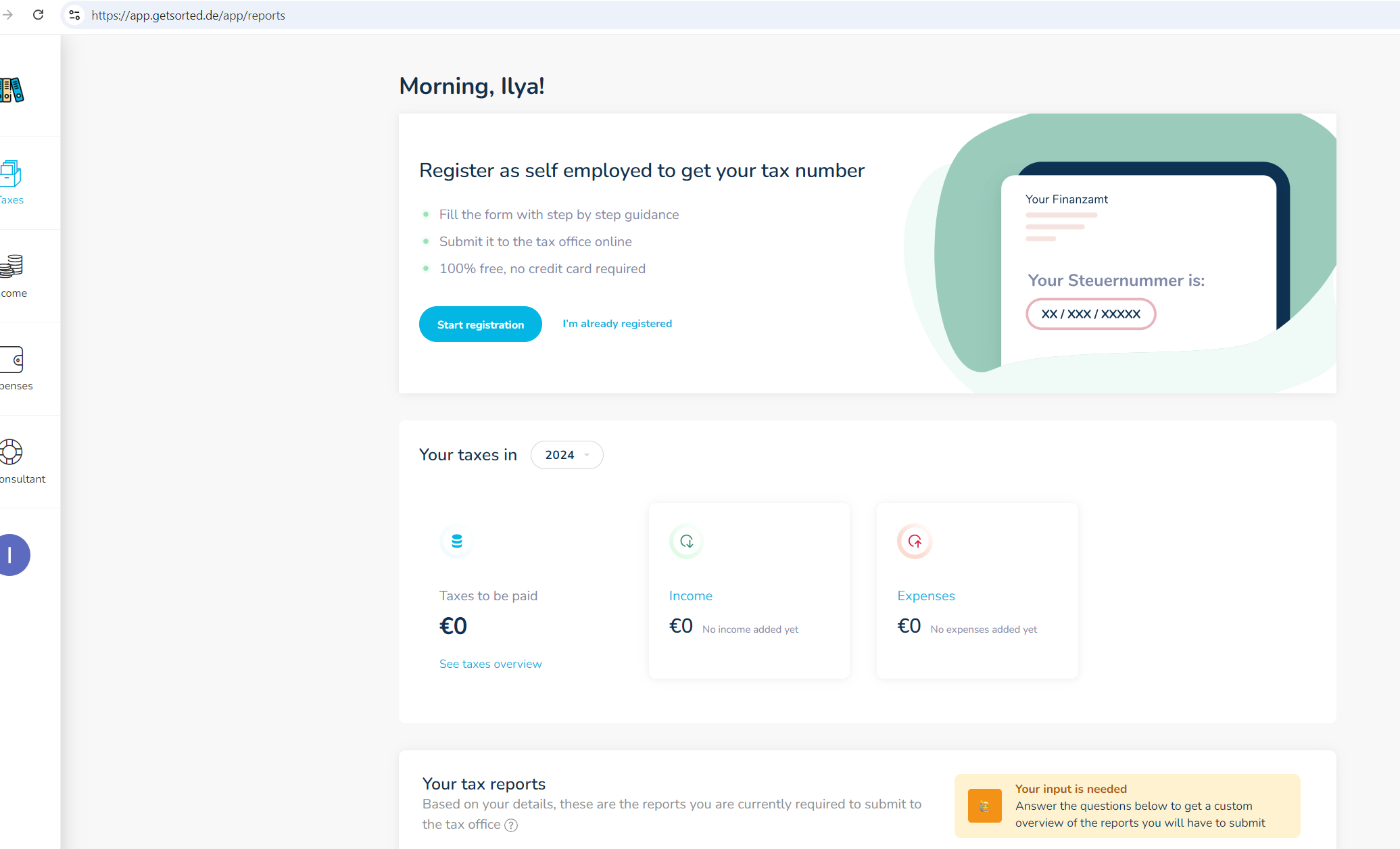

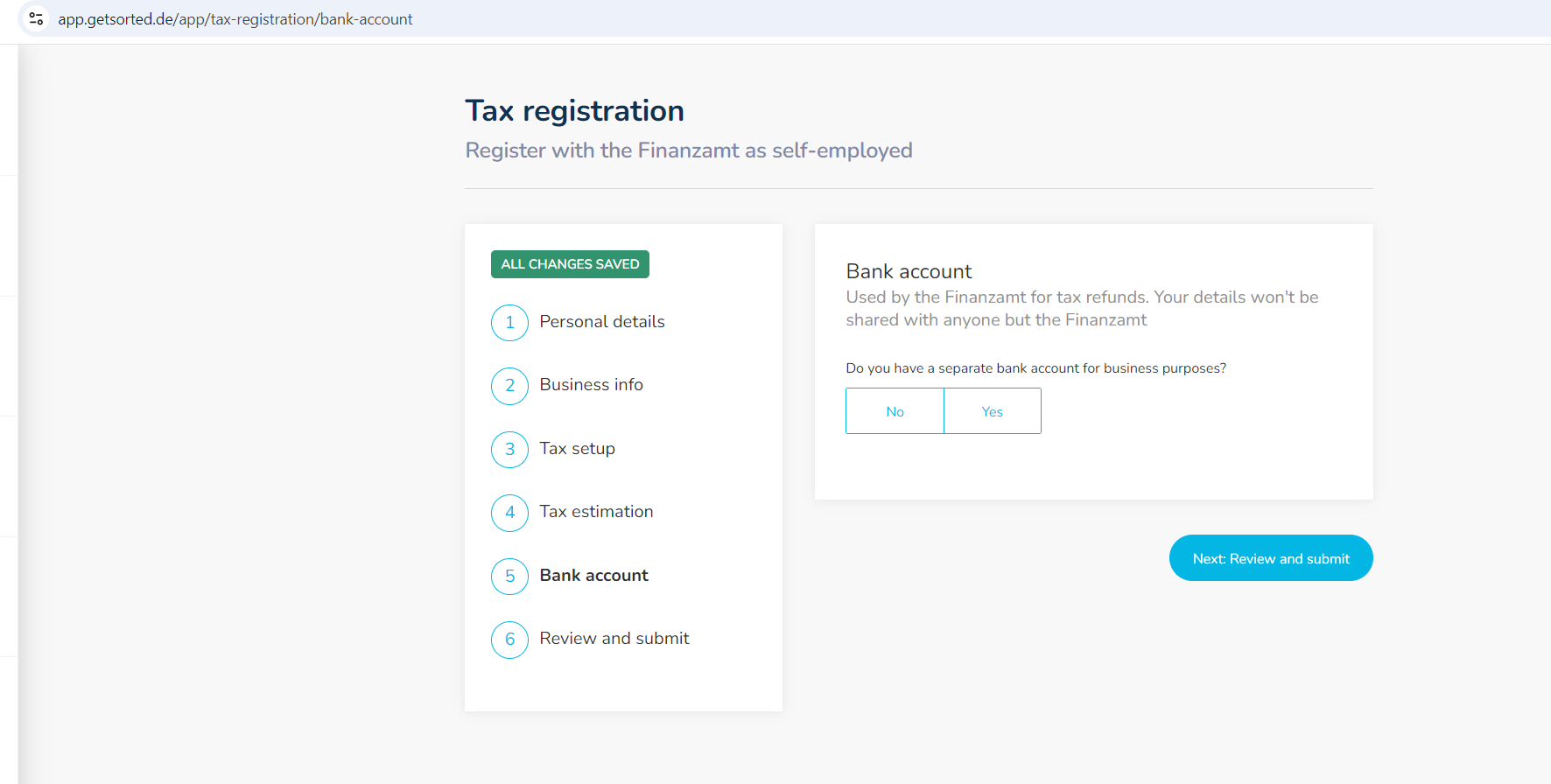

!! Not an advertisement for Getsorted!!

- Register on https://en.getsorted.de

- On the main page, click Start registration

- Fill out the standard Personal Details questionnaire. Be sure to indicate your profession.

- Fill in the Business Info. It is important to specify your profession here so that the system correctly determines whether you are a Freiberufler or a Gewerbe.

- Tax Setup section. In the Profit determination method item , you will most likely choose Single entry bookkeeping. If your revenue exceeds 800 thousand euros per year, then the second option is chosen.

- Tax Estimation section. Here you need to indicate your situation with freelancing, as well as the expected income for the current and next year. I deliberately do not give details, since everyone has different life situations.

- Review and Submit section. In this section, you need to specify the Finanzamt office of the region where you live and click Submit to the Finanzamt.

Detailed registration

Detailed registration requires that you log in to your Elster account and fill out the online form “Fragebogen zur steuerlichen Erfassung“.

I can recommend two detailed videos on filling out the form:

- In Russian by Tupa Germania:

https://www.youtube.com/watch?v=S9eyTPUcp1s

- In German by Steuerfit:

https://www.youtube.com/watch?v=Uqe_tQvaILg&t=1s

Gewerbe registration video (in German)

For Bayern

Register a business – apply for a business license: step-by-step instructions for beginners

For Berlin

Register your business – fill out your business registration: Step by step instructions 2023

Depending on your place of residence and the speed of processing documents, in 2-9 weeks you will receive a confirmation of registration as a freelancer for the specified type of activity, as well as a tax number.

2. About taxes

Taxes are like a mandatory “quest” on the way of any freelancer or business owner in Germany. Although it is not the most exciting, it is certainly necessary, because without passing it, you will face “unpleasant surprises” in the form of fines or questions from the tax service (and it is better not to joke with it!). In this chapter, we will understand the main types of taxes that both freelancers and Gewerbe owners need to pay in order to work legally and sleep peacefully at night.

Types of taxes for freelancers/geverbbe

1. Income tax

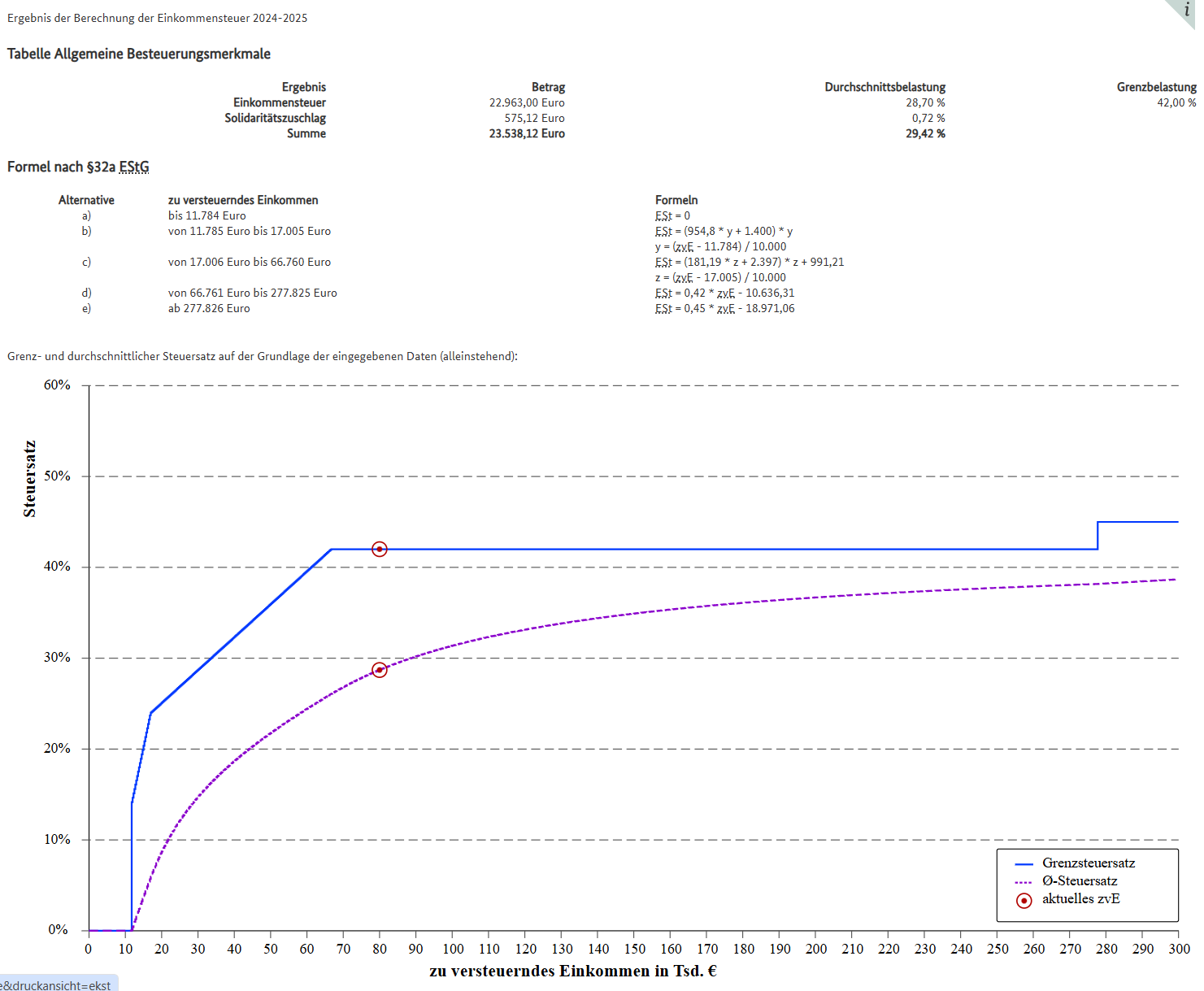

Freelancers and Gewerbe owners, like all taxpayers, are required to pay income tax. This tax is calculated on the basis of net income – the difference between total income and expenses related to doing business. The income tax rate is progressive and depends on the amount of income:

- Up to 12,096 euros per year (in 2025) – 0% tax rate.

- Income between €12,096 and €17,005 is taxed at 14%.

- For incomes between €17,006 and €66,760, the rate increases progressively to 42%.

- For income from 66,761 to 277,825 euros — 42%.

- Income over €277,826 is taxed at 45%.

For example, with an income of 80,000 euros, the tax will not be 42%, as it may seem at the rate for the upper range, but will be around 30-35%. This is because only a portion of income above a certain threshold is taxed at a higher rate. To find out exactly what percentage of tax is on all income, the average effective tax rate is used, which will always be below the highest marginal rate.

https://www.bmf-steuerrechner.de/ekst/eingabeformekst.xhtml

Calculation example:

2. Value Added Tax (VAT) or Umsatzsteuer

Most freelancers and Gewerbe owners are required to pay value-added tax (Mehrwertsteuer, or Umsatzsteuer). The general VAT rate in Germany is 19%, but for some goods and services, such as books and most food, there is a reduced rate of 7%. Exceptions are small entrepreneurs (Kleinunternehmer) whose annual turnover does not exceed 25,000 euros (from 2025) – they may be exempt from VAT.

3. Trade tax

Freelancers are exempt from paying trade tax, which is levied on businesses that conduct commercial activities (Gewerbe). However, Gewerbe owners are required to pay this tax if their annual profit exceeds a certain threshold (about 24,500 euros). Trade tax is calculated on the basis of profits and depends on the rate set by the local authorities. (approximately in the range of 0 to 7%)

4. Cooperative and corporate taxes

Freelancers are not required to pay corporate tax (Körperschaftsteuer), which only applies to capital investments such as GmbH, AG or UG. This allows them to save on taxation, compared to company owners.

VAT (Umsatzsteuer) and peculiarities of its payment

Value added tax (Umsatzsteuer) is levied on most goods and services provided in Germany. It is important to know the specifics of its payment and understand the differences between the two main methods of calculating VAT: Soll-Versteuerung and Ist-Versteuerung.

1. Debit taxation (tax on invoice)

With this method, the freelancer is required to pay VAT at the time of invoicing the client, regardless of whether the invoice has been paid or not. This can lead to situations where taxes have to be paid before the actual money is credited to the account. Soll-Versteuerung is recommended for companies and businesses with high liquidity.

2. Ist-Versteuerung (Taxation upon Receipt of Payment)

With this method, VAT is paid only when the customer has actually paid the invoice. This method helps freelancers better manage their liquidity and reduces the risk of cash gaps. In order to use the Ist-Versteuerung, you must meet certain criteria, including an annual turnover of less than 800,000 euros (from 01.01.2025).

3. Provisional tax returns

Freelancers and Gewerbe owners are required to file provisional VAT returns (Umsatzsteuer-Voranmeldung) every month, quarter or year, depending on the amount of taxes paid for the previous year:

- If the taxes paid exceed 7,500 (9000 from 2025) euros per year, the declaration is submitted monthly.

- If the taxes paid are from 2,001 to 9000 euros, the declaration is submitted quarterly.

- If the taxes are less than 2,000 euros, the declaration is submitted once a year.

The declaration must be submitted by the 10th day of the month following the accounting period.

4. Advance tax payments

Freelancers and Gewerbe owners are required to make advance tax payments (Vorauszahlungen) to avoid a large lump sum at the end of the tax year. Advance payments are determined based on an estimate of estimated revenue reported at enrollment or based on last year’s earnings.

1. How are down payments calculated?

After registering with the tax office, the freelancer or Gewerbe owner must enter their projected income for the year ( Einkommensteuervorauszahlung ). Based on this data, the tax office calculates advance income tax payments. Advance payments are made quarterly on the following dates:

- 10 march,

- 10 June,

- 10 September,

- December 10.

Freelancers or Gewerbe owners will find out how much income tax they will need to pay only at the end of the year. To avoid having to pay a large amount of tax in a lump sum, they make advance payments throughout the year. If your projected income changes during the year, you can request an adjustment to the amount of advance payments from the IRS.

2. Recalculation and final payment of taxes

At the end of the year, a final tax return is submitted, on the basis of which the exact amount of tax is determined. If your advance payments exceed the actual tax liability, the tax administration will refund you the overpaid taxes. It is recommended to set aside money for these payments in advance so that they do not become an unexpected surprise.

If the taxes were underpaid, you will have to pay the remaining amount within a month after receiving the tax notice.

Tax optimization and restrictions for freelancers

Optimizing the tax burden is an important aspect for any freelancer looking to reduce their costs. In Germany, there are several legal ways to optimize taxes, but it is important to understand that any deviation from the law can lead to fines and additional inspections by the tax authorities. The basic principle is that everything related to professional activities and has documentary evidence can be deducted from the tax base. It is important to monitor the safety of all accounts and documents, as well as take into account the deadlines for filing tax returns.

As a freelancer, it is important to know what expenses can be deducted from taxes in order to reduce the tax base and pay less taxes. However, not all expenses can be written off completely, and some of them are subject to restrictions. In this article, we will look at what expenses a freelancer can write off and how to do it correctly in order to optimize tax deductions and avoid problems with the tax office.

What is expense write-off?

Expense write-off is the process of reducing the tax base (the amount on which taxes are calculated) by taking into account the expenses that were made for your professional activities. For example, if you bought a computer for work, its cost can be deducted from income. Writing off expenses helps reduce the amount of taxes you will need to pay.

What expenses can be written off in full?

A full write-off means that you can take into account 100% of the expenses to reduce your taxable profit. Such expenses include office rent, office supplies, insurance policies, professional advice, and some travel expenses. These expenses are directly related to your professional activities and are fully recognized as production expenses.

Examples of fully write-off expenses:

- Office rental (Büromiete): If you rent a separate room for work, these costs can be written off in full.

- Office supplies (Bürobedarf): Purchases of paper, pens, folders and other materials for work are also 100% charged.

- Insurance (Versicherungen): Professional insurances such as business liability insurance and attorney’s insurance, business liability section are completely written off.

- Accounting services (Beratungskosten): Advice on taxation and accounting, as well as other legal services.

What expenses are partially written off?

Partial expenses are those expenses that can only be written off in a certain percentage, as they can have both professional and personal use. For example, if you host business dinners with clients, tax laws only allow you to write off 70% of such expenses, since 30% is considered to be related to the personal element.

Examples of partially write-off expenses:

- Entertainment expenses (Bewirtungskosten): You can only write off 70% of the net amount, but VAT on these expenses can be refunded in full. For example, if you organize a business dinner meeting with a client, only 70% of the cost of this dinner can be written off as production expenses.

- Use of a personal car for work: If you use your personal car for work, then you can only write off the part that corresponds to work trips. Other expenses related to personal use are not written off.

Which expenses are deducted only for VAT (VAT) Abzug nur der MwSt?

Some purchases, such as equipment or vehicles, can be deducted against the VAT you paid at the time of purchase. However, the cost of the equipment itself may not be written off immediately, but in installments through depreciation (Abschreibung, AfA). This is especially important for large purchases, such as a computer or car, which are used in business.

Restrictions on tax write-offs

There are certain expenses that cannot be written off completely or that have limits. For example:

- Gifts to customers (Geschenke an Kunden): If the value of the gift exceeds 50 euros, such gifts cannot be deducted from taxes.

- Business trip meals: These costs can only be deducted within the limits set by the tax office. In Germany, the daily allowance is €14 per day for trips lasting between 8 and 24 hours within the country, and €28 for longer trips.

How to optimize tax deductions?

- Keep track of all expenses. Keep all receipts and receipts related to your professional activities to easily confirm expenses before the tax office.

- Use Cushioning for Large Purchases (AFA Tabelle)

Reference to tables https://www.bundesfinanzministerium.de/Web/DE/Themen/Steuern/Steuerverwaltungu-Steuerrecht/Betriebspruefung/AfA_Tabellen/afa_tabellen.html

If you bought expensive equipment, such as a computer or printer, you can write off its cost in installments over several years. This will reduce the tax base for a long time.

- Separate personal and work expenses. If you use a car, phone, or computer for both work and personal needs, keep a record of how much time or resources are used for professional activities. This will help avoid problems during tax audits.

- Consult an accountant. A professional accountant or tax consultant will help you allocate costs correctly and take advantage of all the opportunities for tax optimization.

Expense table

Below is a table that shows which expenses can be written off in full, and which allow only VAT to be written off:

Business Expenses Deduction Overview (English Translation)

| Type of Expenses | Full Deduction | VAT Deduction Only |

| Office Expenses | Yes (Ja) | – |

| Office Rent | Yes (Ja) | – |

| Office Furniture | Yes (Ja) | – |

| Office Supplies | Yes (Ja) | – |

| Virtual Office | Yes (Ja) | – |

| Technical Equipment | Yes (Ja) | Only VAT, if subject to depreciation |

| Computers | Partially (according to depreciation/AfA) | Yes (on purchase) |

| Software | Yes (Ja) | – |

| Transport Costs | – | Yes (VAT on transport costs) |

| Personal Vehicles for Work Purposes | Partially (according to depreciation/AfA) | Yes (if VAT was paid at purchase) |

| Travel Tickets | Yes (Ja) | – |

| Business Travel Expenses | Yes (Ja) | – |

| Meals on Business Trips | Partially (according to flat-rate rules) | – |

| Work Materials | Yes (Ja) | – |

| Office Supplies (again) | Yes (Ja) | – |

| Professional Literature | Yes (Ja) | – |

| Representation Expenses | Partially (70%) | Yes (full VAT) |

| Gifts to Clients | Not deductible if over €50 | – |

| Depreciation (AfA) | Partially (according to depreciation/AfA) | – |

| Business Insurance | Yes (Ja) | – |

| Accounting and Consulting Services | Yes (Ja) | – |

| Marketing Services | Yes (Ja) | – |

A car for work

When freelancers or other self-employed people use a company car for personal purposes, it is considered a monetary benefit (geldwerter Vorteil) that must be taxed. The German tax office allows two main methods to calculate the private use of a car: the waybill method (Fahrtenbuchmethode) and the 1% method (1-Prozent-Methode). Here’s a detailed explanation of how these methods work and what factors to consider when choosing them.

Vorsteuer with car expenses

- If you are entitled to a Vorsteuerabzug, you can fully deduct VAT from car costs such as fuel, repairs and maintenance.

- For example, if the total costs are €9,450 including VAT (which corresponds to approximately €7,941 excluding VAT and €1,509 VAT), you can refund these €1,509 within the Vorsteuer.

VAT on private use

- When the share of private use is calculated, VAT must be paid on it. For example, in the case of a waybill:

- €1,928 (private use) = net amount.

- 1,928 * 19% = €366.32 (VAT on private use), which must be returned to the state.

1. Waybill Method

This method requires freelancers to record each work-related trip with the following details:

- Date of travel.

- Starting and ending points of the trip.

- Odometer readings at the start and end of the trip.

- The purpose of the trip and, if applicable, the name of the customer or partner.

Advantages of the waybill method

- Suitable for those who rarely use the car for personal purposes, since the calculation of private use will be minimal.

- If the car is old or has already been written off, keeping a waybill is often more profitable than the 1% method.

Disadvantages

- Careful and regular record keeping is required. Any errors or gaps can lead to the refusal of the tax service to recognize this method as valid.

- Manual waybilling can be time-consuming, but there are electronic solutions such as GPS devices and waybill apps that make the process easier.

2. Method 1% (1-Prozent Method)

This method allows the freelancer to calculate the private use of the car based on 1% of the gross sheet value of the car (Brutto-Listenpreis) per month. There are also variations of this method for electric vehicles, where 0.5% or 0.25% is used.

Advantages of the 1% method

- The method is easy to use and does not require the maintenance of waybills.

- Convenient if the car is often used for personal purposes, or if the car is new and has a high sheet value.

Disadvantages

- If the car is old, this method may be less profitable, as the calculation is based on the original cost of the car and not its current market value.

- Higher personal use tax, especially if the car is rarely used for personal travel.

Calculation example

Example of calculation using the waybill maintenance method

Let’s say the total cost of the car was 9,450 euros per year. You drove 24,500 km, of which 19,500 km were related to business trips and 5,000 km were private trips.

- €9,450 * (5,000 km / 24,500 km) = €1,928 is the amount taxable for private use.

Example of calculation using the 1% method

Let’s assume that the gross sheet value of the car is €35,000. With the 1% method, your private expense will be:

€35,000 * 1% * 12 months = €4,200 is the amount for private use of the car.

3. Adjustments: commuting (trip to the first permanent establishment)

If you use a car to commute (e.g. from home to office), you need to add 0.03% of the gross sheet value for each kilometer traveled. For example, with a distance of 10 km and the cost of the car is 35,000 euros, you add:

- 0.03% * 10 km * 12 months = €1,260.

This amount is added to private expenses, but you can also deduct compensation for commuting (Pendlerpauschale) at €0.30 per kilometre.

4. Tax Incentives for Electric Vehicles

There are various tax incentives for electric cars and hybrids. For example, for cars purchased from 2019 onwards, 0.25% of the gross leaf value can be used if the car has zero CO2 emissions and its price does not exceed 60,000 euros.

Example of calculation for an electric car:

Let’s say your electric car costs €52,000 and was purchased in 2020. Using the 0.25% method, your private expenses will be:

- (€52,000 * 0.25%) * 12 months = €1,560.

Conclusion: How to choose between Fahrtenbuch and 1-Prozent-Methode?

- Keeping a waybill is beneficial if you have few private trips or the car is old.

- The 1% method is convenient for those who often use the car for personal needs or if the car is new with a high sheet value.

Each situation is individual, and the choice of method depends on many factors. It is recommended to consult with an accountant or tax consultant in order to choose the most profitable option and not to make mistakes in the calculations.

Personal car for work

Freelancers in Germany can use personal cars for work needs and still have the associated costs deducted from taxes. This can significantly reduce tax liabilities if all the nuances are properly taken into account. In this article, we will look at how a freelancer can competently use a personal car for work and what tax benefits can be obtained in this case.

1. Legal basis for writing off expenses

When a freelancer uses a personal car to perform work tasks, such trips may be recognized as professional, and the costs associated with them can be taken into account as business expenses. However, it is important to separate business and personal travel, as the tax authorities require accurate accounting. In case of incorrect accounting, the freelancer may be denied to write off part of the expenses.

2. How to Separate Personal and Professional Car Use

To separate work and personal trips, you need to keep a travel log (Fahrtenbuch). This is a mandatory requirement if you plan to write off actual expenses. The following data should be recorded in the log:

- Date of travel

- Purpose of the trip

- Destination

- Distance traveled (in kilometers)

- Travel time

This journal serves as evidence of the share of official use of the car and is used to calculate the proportional part of the expenses that can be written off from taxes.

3. Methods of accounting for expenses

There are two main methods for writing off car expenses:

- Actual costs. This method requires you to record all the real costs of the car that are associated with its operation: fuel, maintenance, insurance, vehicle tax, depreciation, and even parking. These costs are then divided proportionally between personal and work use based on the trip log.

- Fixed rate per kilometer. If you find it difficult to keep track of all expenses, you can use the simplified method of writing off 30 cents for each kilometer traveled for work purposes. To do this, you will also need to keep a trip log, but accounting for individual car costs is not necessary.

4. Registration of the car in the name of the company

If the car is registered to a company, all expenses for its operation, including purchase, insurance and maintenance, can be taken into account as corporate expenses. However, it is important to understand that the car becomes an asset of the company, which imposes certain obligations. For example, you will have to take into account the depreciation of the car and correctly calculate its use for personal needs.

In addition, if you use the car for both business and personal purposes, the tax authorities may consider the use of the car for personal needs as an additional remuneration that is also subject to taxation.

5. Depreciation and Cost Reduction

Car depreciation is the process of gradually writing off its value over several years. Depending on the value of the car and its estimated lifespan, the freelancer may charge part of the cost annually. This method is especially useful if you bought a car specifically for business or use it primarily for work purposes.

Calculation example

Let’s say a freelancer uses a personal car that is used for both personal and work purposes. A freelancer keeps a trip log and determines that 60% of the car’s mileage is related to business trips. Let’s consider two scenarios: calculation based on actual costs and a flat rate per kilometer.

- Total car costs per year:

- Fuel: 1500 euros

- Insurance: €600

- Maintenance: €300

- Other costs: 200 euros

- Total: 2600 euros

- Actual cost method:

Of the total expenses, 60% is related to business trips, so you can write off:

2600×0.60=1560 euros - Fixed rate method:

A freelancer has traveled 8000 km in a year for work purposes. Taking into account a fixed rate of 30 cents per kilometer:

8000×0.30 = 2400 euros

As you can see from the example, the fixed rate method allows you to write off more funds, but depending on the situation with actual expenses, this method may not always be profitable. A freelancer should analyze his costs and choose the most suitable option.

Kinderfreibetrag: Tax relief for parents

Raising children is not only a joy, but also a significant financial cost. In order to support parents, the state provides tax deductions, one of which is the Kinderfreibetrag – a child deduction provided for in accordance with § 32 Einkommensteuergesetz (EStG). This deduction reduces the tax base, which leads to a lower tax burden for parents.

Highlights about Kinderfreibetrag:

- Size of Kinderfreibetrag:

- In 2023, the deduction is 8,952 euros per child.

- In 2024, the amount increases to 9,540 euros per child.

- In 2025, the amount increases to 9,600 euros per child.

This deduction has two components: Freibetrag für das Existenzminimum des Kindes (deduction for the minimum needs of the child) and Freibetrag für den Betreuungs-, Erziehungs- und Ausbildungsbedarf (deduction for care, upbringing and education).

- Who is Kinderfreibetrag available for:

- Kinderfreibetrag is only available to taxpayers in tax classes I-IV.

- Parents living together apply for a deduction together and receive the full amount.

- Parents living separately can divide the Kinderfreibetrag in half, each of them receives 50% of the total amount.

- Choosing between Kinderfreibetrag and Kindergeld: It is important to remember that parents can choose either Kindergeld (monthly payments per child) or Kinderfreibetrag (checking which is more profitable). As a rule, the child deduction becomes more advantageous if the annual income exceeds €64,000 for married couples or €32,000 for single parents.

- How to get a Kinderfreibetrag: To use the Kinderfreibetrag, you must provide it when submitting your tax return. The tax office will do the calculation and tell you in the tax notice (Steuerbescheid) which turned out to be more profitable: Kinderfreibetrag or Kindergeld.

Additional deduction: Education allowance

If your child is older and is studying or at university, you can also get an Ausbildungsfreibetrag. This deduction is intended to cover the costs associated with the children’s education.

- Until 2022, the Ausbildungsfreibetrag was 924 euros per year.

- From 2023, the amount has increased to 1,200 euros per year.

This deduction is in addition to the Kinderfreibetrag if you are still eligible for a Kindergeld for a child who is in school.

Kinderfreibetrag Case Study

Suppose you have one child and you decide to use Kinderfreibetrag in 2024:

- Deduction amount: €9,540* will be deducted from your tax base.

- Tax reduction: If you pay tax at a rate of 30%, this will reduce your tax burden by approximately €2,862 (30% of €9,540).

*2025: €9,600

If your income exceeds the threshold for Kindergeld, Kinderfreibetrag can provide you with a significant tax advantage.

How to account for expenses and keep receipts?

In order for all these expenses to be accepted by the tax authorities, it is necessary to document them correctly. Each purchase or payment for services should be accompanied by a receipt or invoice, which should indicate the date, amount, description of the purchase and the name of the seller company. All documents must be kept for 10 years in order to have evidence in the event of a tax audit.

Simplified deductions (Fixed lump sums)

Some expenses can be written off without providing checks and documents if the lump-sum deduction system is used. For example, the lump-sum rate for the use of a home office is €6 for each working day spent at home, but not more than €1260 per year (for 2024). There are other lump-sum rates, such as small expenses for office supplies.

Applications of the Kleinunternehmerregelung

In Germany, from 2025, the annual turnover limit for entrepreneurs applying the status of Kleinunternehmer (MwSt) has been increased from 22,000 to 25,000 euros. If your annual turnover does not exceed €25,000, you can take advantage of this status and be exempt from the obligation to collect and pay VAT. However, if your turnover exceeds this threshold, you will be required to switch to the standard VAT payment system.

Please note that when calculating the annual turnover, all income from business activities is taken into account. If your turnover exceeds €25,000 during the year, you must notify the tax authorities and start collecting VAT from your customers, as well as submit the relevant tax returns.

For more information, it is recommended to consult official sources such as the German Federal Ministry of Finance (Bundesministerium der Finanzen) or consult a tax advisor.Accounting for depreciation of assets

Freelancers can account for the depreciation of large acquisitions (e.g., computers, office furniture, equipment) over several years. This allows you to evenly distribute tax deductions over several tax periods.

Using European Small Business Regulation from 2025

From 1 January 2025, a new rule for small entrepreneurs, known as the Europäische Kleinunternehmerregelung, will come into force within the European Union. This rule is aimed at simplifying tax administration for small businesses and individual entrepreneurs, as well as unifying VAT requirements in different EU countries. In this article, we’ll take a closer look at how the new rule will work, who will be able to use it, and what benefits it will bring.

The essence of the new rule

The Europäische Kleinunternehmerregelung offers small businesses with an annual turnover of up to €85,000 to avoid paying value added tax (VAT) within the EU. This rule replaces the national turnover thresholds that have existed in each country until now.

The essence of the new approach:

- If the annual turnover of an entrepreneur does not exceed €85,000, he can be exempt from VAT.

- The exemption applies to the entire EU internal market, eliminating the need to register VAT in other countries when selling goods or services abroad.

- To maintain the status of a small entrepreneur, it is necessary to meet the new criteria every calendar year.

Who is this rule suitable for?

The new rule applies to small businesses and individual entrepreneurs registered in one of the EU countries that meet the following criteria:

- Annual turnover up to €85,000. This limit includes all income from the sale of goods and services, both domestically and internationally.

- Place of main activity. The entrepreneur must have its principal place of business in one of the EU countries.

- Voluntary Use. The new rule is not mandatory. Entrepreneurs who benefit from staying in the VAT system can continue to work under the old rules.

Advantages

- Reduced administrative burden: no need to file VAT returns, register in other EU countries and comply with complex cross-border trade rules.

- Simplified accounting: less paperwork and reporting.

- Cost reduction: The absence of an obligation to pay VAT allows entrepreneurs to offer more competitive prices.

Limitations and Exclusions

Despite the numerous benefits, there are some limitations to be aware of:

- If the turnover exceeds €85,000 during the year, the entrepreneur automatically loses the right to VAT exemption and must register as a VAT payer.

- The exemption does not apply to imports of goods from countries outside the EU.

- Some activities, such as the sale of excise goods (e.g. alcohol and tobacco), are excluded from this rule.

Procedure for use

In order to take advantage of the new rule, an entrepreneur must:

- Register with the tax authorities of your country and apply for the Europäische Kleinunternehmerregelung.

- Make sure that the annual turnover does not exceed the established limit.

- Keep records of income to confirm the right to VAT exemption.

Limitations and risks

It is important to remember that the tax service closely monitors all attempts to illegally reduce the tax base. Attempts to hide income or exaggerate expenses can lead to fines and additional tax audits. Therefore, when optimizing taxes, it is better to seek advice from a professional tax consultant

Tax Calculator

In addition to the theory, link to the tax calculator:

https://www.bmf-steuerrechner.de/ekst/eingabeformekst.xhtml

Tax Consultant

Handling tax affairs in Germany can be a daunting task for most people, especially when it comes to self-employed, freelancers, or business owners. This is where a tax advisor (Steuerberater) comes in. In this article, we will look at why it is important to contact specialists, in what situations it is necessary, how to choose the right specialist, and share useful resources for finding a tax consultant in Germany. It is not necessary to look for a Russian/English-speaking consultant, since most of the communication takes place in writing, and you can calmly and slowly translate all your requests through Deepl / ChatGPT

1. Who is a tax consultant and what services does he provide?

A tax consultant is a licensed professional who helps individuals and companies deal with tax issues. In Germany, tax advisors are required to be members of the tax chamber (Steuerberaterkammer) and undergo strict professional certification.

The services of a tax consultant may include:

- Preparation and submission of tax returns (for both individuals and companies);

- Consulting on tax planning and optimization;

- Preparation of accounting reports for companies;

- Support in tax disputes and proceedings;

- Support during tax audits;

- Tax accounting assistance for self-employed individuals, freelancers, and small businesses.

2. When should I contact a tax advisor?

Some categories of citizens should especially seriously consider the possibility of cooperation with a tax consultant. Here are a few cases where the help of a tax advisor may be necessary:

- Freelancers and self-employed: Self-employment means keeping track of all income and expenses, as well as filing tax returns regularly. Even a small mistake can result in penalties.

- Business owners: Accounting and tax reporting for companies is a complex and responsible task. A tax consultant will help you avoid mistakes, optimize taxes and make sure that all financial transactions comply with the law.

- Dealing with investments or income abroad: If you have income from other countries or invest in international projects, the tax situation becomes more complicated. A consultant will help you correctly declare such income, take into account the peculiarities of international taxation and avoid double taxation.

- Selling or renting out real estate: In these cases, there are various tax benefits and exclusions that can be taken advantage of, but only with a competent approach. A tax consultant will advise you on how to properly account for income from renting or selling real estate in order to minimize tax liabilities.

- Tax audit: If you are facing an audit by the tax authorities, professional advice can greatly facilitate the process and protect your interests. A tax consultant will prepare all the necessary documents, explain controversial issues to the tax authorities and help minimize possible risks and penalties.

When can you do without a tax consultant?

Despite all the advantages of working with a tax consultant, there are situations when you can cope on your own and save on his services:

- Low or irregular income: If your freelance income is small (e.g. less than €20,000 per year) or irregular and your tax situation is simple enough, you can do without a tax advisor. In this case, the costs of professional services may be disproportionately high compared to the potential tax savings. which will help to take into account the main income and expenses.

- Standard tax deductions: If you only claim standard tax deductions (e.g., travel expenses, work tools, standard insurance), then you probably won’t need professional help filing your return. Standard deductions are easy to claim on your return and don’t require complex calculations.

- Use of tax software: There are many tax preparation and filing programs available today that can be useful for individuals with a simple tax situation. Such programs usually offer step-by-step instructions that simplify the process and avoid mistakes.

- Self-filing experience: If you already have experience filing your tax return on your own and your financial situation hasn’t changed, you may be able to handle it without the help of an advisor. Over time, many people gain enough knowledge to handle their tax affairs on their own.

When should you think about a tax consultant depending on income?

The level of income directly affects the complexity of your tax situation and, therefore, the need for the services of a tax consultant:

- Income of up to €20,000 per year: With this level of income, the tax situation is usually quite simple. In most cases, if you do not have additional complex sources of income (such as overseas investment or renting out real estate), you will be able to handle your tax return on your own using the available online tools and programs.

- Income from 20,000 to 50,000 euros per year: As income increases, the tax situation becomes more complicated. Here you may have questions about tax optimization, accounting for business expenses and the use of tax benefits. If your income is growing, it is worth considering at least a one-time consultation with a tax consultant.

- Income over €50,000 per year: With an income above this mark, especially if you work with several clients or lead large projects, the services of a tax consultant become almost necessary. In this case, a professional will help you optimize taxes, take into account all possible expenses, avoid mistakes that can lead to serious fines, and ensure competent financial planning.

3. How much do tax consultant services cost?

In Germany, the cost of a tax consultant’s services is regulated by the fee legislation (Steuerberatervergütungsverordnung). The amount of the fee depends on several factors:

- Complexity and amount of work: The more complex the task, the higher the cost will be.

- Your income: The higher your income or business turnover, the more time the consultant will spend on your tax reporting.

Sample rates for individuals range from €150 to €500 for preparing a tax return. For entrepreneurs or small business owners, the amount can increase significantly depending on the complexity of the bookkeeping.

4. How to choose a tax consultant?

Here are some tips for choosing a tax advisor:

- Check the licenses and membership of the tax chamber. Every qualified tax advisor must be registered with the German Tax Chamber (Steuerberaterkammer). This ensures that they have the necessary knowledge and undergo regular further training.

- Review reviews and recommendations. An important criterion may be the reputation of the consultant among other clients. If you have acquaintances who have used the services of a tax consultant, ask for their opinion.

- Consider specialization. Some tax advisors specialize in working with individuals, while others specialize in small businesses or companies. If you’re a freelancer or business owner, choose a consultant who has experience working with such clients.

- Assess accessibility. It is important that a tax advisor is available to answer your questions in a timely manner, especially in the case of tax audits or urgent filings.

Where to look for a tax consultant?

Below are some useful resources where you can find a tax advisor in Germany:

- Steuerberater.de

This is one of the largest directories of tax consultants in Germany. The platform allows you to filter consultants by location and specialization. - Steuerberater Verzeichnis

This site provides a database of certified tax consultants where you can search for specialists by city or region. - DATEV eG

The DATEV Association is a network of professionals in the field of accounting and taxation. They offer the search for qualified tax consultants working using modern accounting technologies. - The German

Chamber of Auditors (Wirtschaftsprüferkammer) also has a register of tax advisors, especially for complex cases involving business or international transactions. - MeineStadt.de

A portal for finding various specialists, including tax advisors, in specific cities and regions of Germany.

6. Conclusion

Tax laws in Germany are quite complicated, especially for those who run a business or work as a freelancer. The decision to contact a tax advisor depends on your income level and the complexity of your tax situation. With small incomes, you can cope on your own, but as they grow and the financial situation becomes more complicated, it becomes advisable to turn to a professional. This will help not only to save time, but also to avoid mistakes, as well as possible problems with the tax authorities.

A tax consultant is not just an assistant in filing returns, but a reliable partner who helps to optimize taxes and feel confident in communicating with the tax authorities. Using the resources listed above, you can find a specialist who is right for you and will help you cope with any tax difficulties.

3. Accounting and Accounts

Freelancers in Germany can use a simplified accounting system – Einnahmen-Überschuss-Rechnung (EÜR), which translates as “calculation of income and expenses”. This system is designed for small entrepreneurs whose annual turnover does not exceed 800,000 euros, and it is simpler compared to double-entry bookkeeping.

EÜR Highlights

- Income: All money that comes into your account or in cash must be recorded.

- Expenses: All professional expenses, including office rent, transport, marketing, equipment and other expenses, are also recorded.

- VAT deduction: If you are registered for VAT (Umsatzsteuer), you can deduct VAT on purchases related to your professional activities.

- Final Profit: Final profit is calculated as the difference between income and expenses. This is the amount that is subject to income tax.

The EÜR can be submitted electronically via the ELSTER portal, which is used for all tax transactions in Germany. And you can also use Getsorted or other accounting software.

How does EÜR work?

In the EÜR, income and expenditure are allocated according to the principle of actual receipt or expenditure of funds. This is called Zu- und Abflussprinzip:

- Income is taken into account when the money is credited to the account (for example, when paying by card or when making a bank transfer).

- The expense is recorded at the moment when the money is actually debited from the account.

A distinctive feature of EÜR is that there is no need to use such complex accounting mechanisms as depreciation accruals or reserves, which are necessary in the double-entry bookkeeping system.

Who is required to file an EÜR?

The following categories of entrepreneurs are required to submit an EÜR:

- Small entrepreneurs (Kleinunternehmer) whose annual income does not exceed 25,000 euros.

- Freelancers who work in the scientific, artistic, educational, or consulting fields.

- Individual entrepreneurs, if their annual turnover does not exceed 600,000 euros and 800,000 (after 01.01.2027) and p, and the profit is 60,000 euros.

How do I create and submit an EÜR?

In order to create and submit an EÜR, you need to register on the ELSTER portal , which is the official online tool for filing tax returns in Germany. After registering on the ELSTER platform, you can fill out the EÜR form online. To do this, log in to your personal account, select the “Formulare & Leistungen” section and find the “Einnahmenüberschusrechnung (Anlage EÜR)” form

Stages of EÜR registration

Filling out the form

After registering on the ELSTER platform, you will get access to the EÜR form. In this form, you must specify:

- Income: All income that you have received as part of your activity.

- Expenses: All expenses related to your activities (office rent, equipment, software, etc.).

Filling options:

- Manual filling: Directly on the ELSTER website.

- Automation: Use accounting software to simplify the process and minimize errors. Programs automatically populate and export data to ELSTER.

Submission of documents

Although the documents themselves (for example, invoices, checks, contracts) do not need to be attached to the declaration, it is important to follow the following rules:

- Document retention:

All supporting documents must be kept for a minimum of 10 years in case of inspection by the tax authorities. This applies to both paper and digital documents. - Examples of documents to be stored:

- Invoices from customers.

- Invoices.

- Receipts confirming purchases.

- Bank statements.

Tip: Use cloud-based document storage solutions to avoid document loss and provide quick access when needed.

What costs can be taken into account in EÜR?

The following costs can be taken into account in the EÜR:

- Equipment costs (e.g., computers, furniture).

- Transportation costs (travel to customers, delivery of goods).

- Training and professional development costs.

- Expenses for renting an office or home office (if it is used for work).

- Depreciation of goods that last more than one year (e.g., car, computer).

- Advertising and marketing costs.

Accounting Software

Manual bookkeeping can be a complex and time-consuming process. Fortunately, there are many software solutions on the market that help automate accounting, invoicing, VAT accounting, and reporting for the tax office.

Popular accounting software

- LexOffice is one of the most popular software for small businesses and freelancers in Germany. It offers simple record keeping, automated invoicing, VAT calculation, and reporting via ELSTER.

- SevDesk is a cloud-based freelancer solution that allows you to keep track of income and expenses, manage client accounts, and send tax returns online.

- FastBill is a service that automates the management of invoices, taxes, and payments, simplifying the work of freelancers and small businesses.

- Getsorted is a popular accounting program for freelancers and small business owners in Germany. It is designed to make it easier to manage financial and tax obligations, especially for those who do not have in-depth knowledge of accounting.

Each of these solutions has its own advantages, so it’s important to choose the one that best suits your needs and type of activity. I’m currently using Lexoffice because Getsorted doesn’t cover my needs.

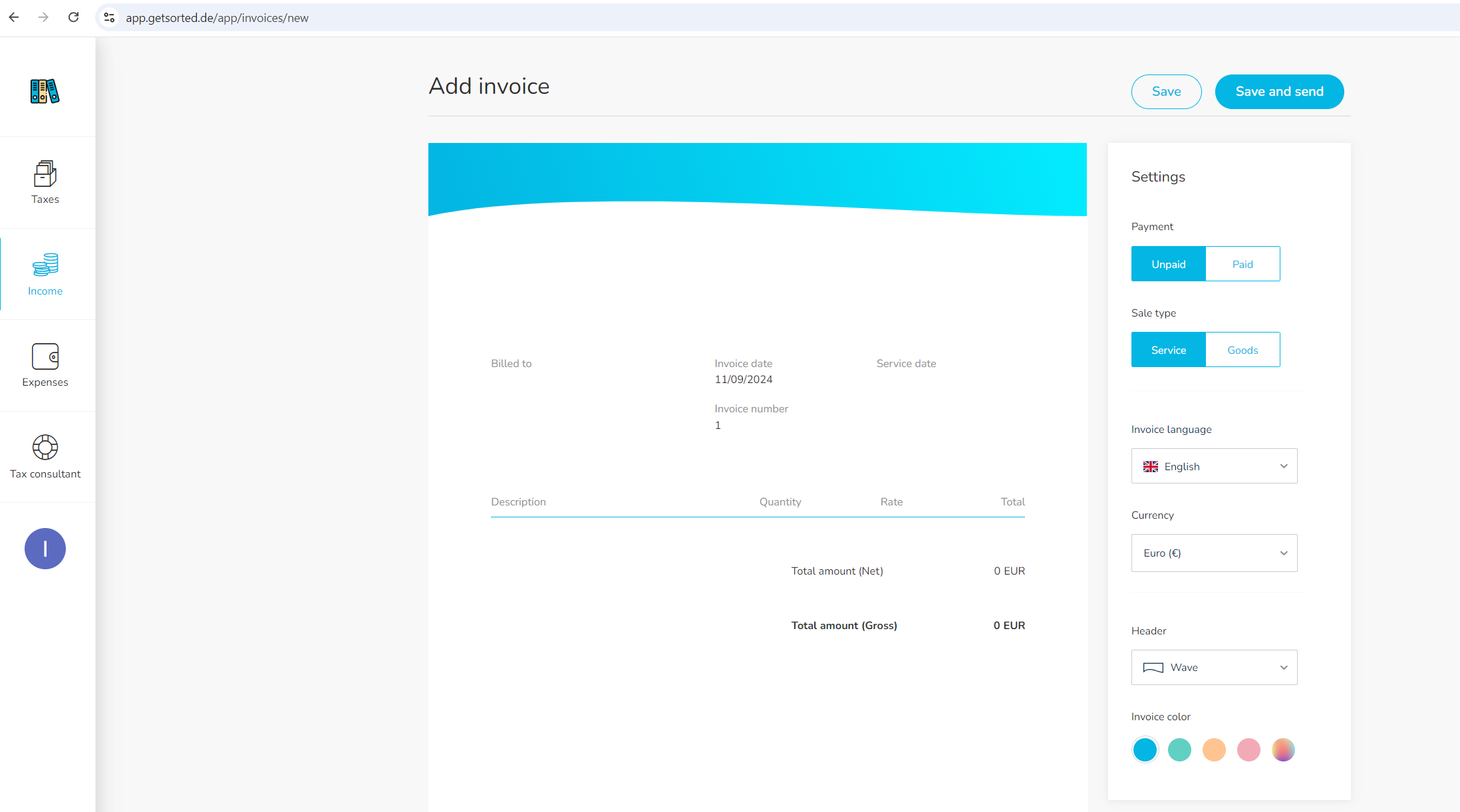

Billing

In Germany, freelancers are required to follow strict rules when invoicing (Rechnung) and starting from January 1, 2025, Germany begins to phase out the mandatory use of e-invoices. An important point is that from this date, companies are required to be ready to accept e-invoices, while the obligation to issue them is introduced gradually and depends on the size of the company and other factors. Regardless of whether you provide services domestically, within the EU or outside it, each invoice must meet certain legal requirements. Failure to comply with these requirements may result in the refusal to recognize your expenses and revenues by the tax authorities. In this article, we will look at what mandatory elements must be present on each account in order for it to comply with the law.

Contact information

Each invoice must include your full contact details as well as customer details. This includes:

- Your name or company name.

- Address.

- Phone number and email address.

- Customer contact details, including name and address.

Invoice number (Rechnungsnummer) and invoice date (Rechnungsdatum)

Each invoice must contain a unique invoice number (Rechnungsnummer) that helps identify and track the document. The invoice date (Rechnungsdatum) must also be indicated. The account number should be sequential and not contain repetitions.

3. Tax number (Steuernummer) or VAT-number (Umsatzsteuer-Identifikationsnummer)

You are required to enter your tax number (Steuernummer) on your account, which is assigned to you by the tax authorities. If you are required to collect VAT (Umsatzsteuer), you also need to provide your VAT identification number (Umsatzsteuer-Identifikationsnummer). In cases where you work with clients from other EU countries, be sure to provide the client’s VAT number.

4. Description of the service

Each invoice must contain a clear and complete description of the services you have provided. It is necessary to indicate:

- Type of service (e.g., consulting services, software development).

- The dates or period during which the service was provided.

- Number of hours of work or the amount of work performed.

This helps to avoid misunderstandings with customers and confirms what you are being charged for.

5. Prices and amounts (Preis und Betrag)

The following amounts must be indicated on the account:

- The cost of the service is exclusive of VAT.

- VAT amount (Umsatzsteuer), if applicable.

- Total amount including VAT.

If you work under the Kleinunternehmerregelung (simplified system for small entrepreneurs), please indicate that VAT is not charged according to § 19 UStG (German Tax Code). For example: “Gemäß § 19 UStG wird keine Umsatzsteuer berechnet.”

6. Payment conditions

The invoice must state the terms of payment (Zahlungsbedingungen), such as the due date and available payment methods. For example:

- Payment within 14 or 30 days from the date of receipt of the invoice.

- Bank details for the transfer (IBAN and BIC).

You can also specify that penalties may be charged if payment is delayed.

7.What is an electronic invoice (E-Rechnung)?

An electronic invoice is an invoice that is created, sent and received in a structured electronic format that allows its automatic processing. It is not just a PDF or a scanned document, but data that can be immediately integrated into the accounting system. The main standards applied in Germany are ZUGFeRD and XRechnung.

Step-by-step introduction of mandatory e-invoicing

Stage 1: January 1, 2025 – December 31, 2026

- Mandatory acceptance of e-invoices: All B2B companies must be ready to accept e-invoices in established formats (e.g. XRechnung or Factur-X).

- Invoicing: Remains optional, companies can continue to use paper invoices, PDFs, and other formats. However, sending PDFs is only allowed with the consent of the recipient.

- Preparation: At this stage, it is recommended to start adapting systems for sending electronic invoices.

Stage 2: January 1, 2027 – December 31, 2027

- For companies with an annual turnover of more than €800,000 in the previous year:

E-invoicing becomes mandatory for all B2B transactions. - Companies with a turnover of up to €800,000 in the previous year:

can continue to send paper invoices or – with the consent of the invoice recipient – another electronic invoice format, such as PDF. - EDI (Electronic Data Interchange): Remains a valid alternative.

Key exceptions

Some categories of transactions are exempt from the e-invoicing requirement:

- Tax exemptions (e.g. medical services).

- Invoices for a small amount of up to €250 can still be sent as “other invoices”, e.g. in paper form. This also applies to travel tickets. Invoices for services that are not taxable in accordance with § 4 No 8-29 (Value Added Tax Act) are also tax-free.

Small Enterprises (Kleinunternehmer) (Section 19 of the Value Added Tax Act)

Under the new provisions of the Income Tax Act 2024, effective from 1 January 2025, sales of small businesses are exempt from VAT (without the right to deduct input tax). Therefore, they are not required to issue electronic invoices in the new format. Invoices can still be issued on paper or in another electronic format (e.g. PDF).

IMPORTANT: The obligation to receive electronic VAT invoices remains for small businesses.

8. VAT Provision (Reverse-Charge for International Transactions in the EU)

If you’re invoicing a customer from another EU country and a Reverse-Charge system applies, this must be clearly stated on the invoice.

What does it mean?

In this case, the customer is responsible for paying VAT. You do not charge VAT on the service, but you must include the appropriate wording on the invoice. For example:

“Steuerschuldnerschaft des Leistungsempfängers” (VAT is paid by the customer of the service).

What is important to remember?

- Make sure your customer has a valid VAT number that can be verified via LIVES.

- The transaction must be reflected in tax returns, including the Zusammenfassende Meldung in Germany.

Invoicing (outside the EU)

1. Accounts for customers outside the EU (Reverse Charge)

If you provide services to customers located outside the EU, you are exempt from VAT in Germany. This is due to the provision of § 4 Nr. 1a UStG (Value Added Tax Act).

The invoice must indicate that this transaction is exempt from VAT. Example of wording:

“Umsatzsteuerfrei nach § 4 Nr. 1a UStG.”

2. Exchange rates

If the invoice is issued in a currency other than the euro, you should:

- Specify the exchange rate at the time of invoicing.

- For example, “Payment in euros or in the specified foreign currency at the current exchange rate.”

Invoicing template

It is also important to note that in the Accounting software and online banks for business there is already a built-in invoicing functionality, where it is enough to fill in the missing fields.

An example from getsorted:

Invoicing through the website and online platforms

1. What is Stripe and how does it work?

Stripe is an online payment platform that makes it easy for businesses and freelancers to accept payments online. Stripe supports a variety of payment methods, including credit and debit cards, bank transfers, and local payment methods such as Sofort and Giropay, which is especially true for freelancers in Germany.

Stripe’s main advantage is its simplicity and flexibility. With Stripe, you can easily issue invoices, accept payments, and manage financial transactions without having to deal with the complexities of traditional banking systems.

2. Benefits of Using Stripe for Freelancers

- Ease of integration: Stripe offers easy integrations with websites and platforms like WordPress, WooCommerce, or even self-written sites via API. If you don’t have a website, you can still use Stripe to create payment links or billing.

- Support for Multiple Payment Methods: Stripe allows you to accept payments with a variety of methods, including:

- Credit and debit cards (Visa, MasterCard, American Express, etc.)

- Bank Transfers (SEPA)

- Local payment methods popular in Germany (Sofort, Giropay)

- Mobile payments (Apple Pay, Google Pay)

- High level of security: Stripe is PCI-DSS compliant and uses advanced encryption technology to protect payment data. This gives your customers peace of mind that their data is safe.

- Automation of the payment process: Stripe provides the ability to automatically exhibit invoices, send payment reminders, and send regular charges, which is especially useful for freelancers working on a subscription basis or long-term contracts.

- Multi-currency: Stripe allows you to accept payments in more than 135 currencies, making it easy to work with customers from different countries.

3. How to Set Up Stripe to Accept Payments

Register and set up an account

- Create an account on Stripe: Go to stripe.com and register. You will be required to provide information about your business, such as name, address, type of activity, and bank details for withdrawals.

- Go through the verification process: Stripe requires proof of identity and banking information. To do this, you will need to upload documents proving your identity (such as a passport or ID card), as well as provide a valid bank account.

Setting up payment methods

- Choosing payment methods: In your Stripe account, go to the “Payments” section and select the payment methods you want to offer to your customers. For German customers, it is useful to set up SEPA Direct Debit, Sofort, Giropay, and other popular payment methods in Germany.

- Integration with your website: If you have a website, Stripe provides out-of-the-box integration solutions such as WordPress/WooCommerce plugins or website builders. If you’re designing your site yourself, the Stripe API provides a complete set of tools for creating a customized payment process.

- Creating payment links: If you don’t have a website, you can use the “Payment Links” functionality in Stripe. This feature allows you to create a unique payment link that can be sent to the customer via email or instant messengers.

4. Invoicing and receiving payments

- Create an invoice: Stripe has a feature for creating and sending invoices to clients. This is especially handy for freelancers, as you can customize the invoice template, specify a description of the services, quantity, and apply tax (if applicable).

- Receiving payment: After sending the invoice to the customer, Stripe will notify you when the payment has been made. The funds are credited to your Stripe account and you can then withdraw them to your bank account.

- Automation: Stripe allows you to set up automatic charges, which is ideal for recurring payments, such as subscription-based or recurring service payments.

5. Fees and Withdrawals

- Fees: Stripe charges a fee for each transaction. For European cards, the fee is 1.4% + €0.25 per transaction, for non-European cards it is 2.9% + €0.25. Additional fees may be charged for certain types of payments, such as international transfers.

- Withdrawals: Funds can be withdrawn to your bank account automatically according to a schedule (daily, weekly, monthly) or manually. Usually, funds reach your bank account within 2-7 days.

6. Features of using Stripe in Germany

- Taxation: In Germany, freelancers are required to declare VAT (Mehrwertsteuer) on invoices to clients if your annual income exceeds a certain threshold. Stripe allows you to automatically add value-added tax to your invoices. Do not forget to consult with a tax consultant to properly configure the system in accordance with the requirements of German tax law.

- Local payment methods: Stripe supports popular payment methods in Germany, such as SEPA Direct Debit, Giropay, and Sofort, making it more convenient for your customers to pay.

- Accounting The platform provides detailed transaction reports, making it easier to keep records and prepare for tax filings. Integrations with popular accounting systems such as DATEV, Xero, and QuickBooks are also available.

7. Practical tips for working with Stripe

- Testing: Before you start accepting payments from customers, test the payment process using Stripe’s “Test Mode”. This will make sure that everything is set up correctly and payments will go through smoothly.

- Use reports: Stripe provides detailed transaction reports, making it easy to manage your finances and prepare for tax reporting.

- Customer Support: Stripe offers an extensive knowledge base and support team to reach out to in case of questions or issues.

What is Wise Business and how does it work?

Wise Business is an online service that allows freelancers and businesses to send and receive international payments using real-world exchange rates. This means there are no hidden fees or markups on currency conversions. The platform supports multi-currency accounts, making it ideal for those working with clients around the world.

The service is especially useful for businesses that regularly issue invoices in different currencies. Wise Business simplifies the payment process and makes it transparent for both the sender and the recipient.

Benefits of Using Wise Business for Freelancers

- Low fees : Wise Business charges a fixed fee and a percentage of the transfer amount. It’s much cheaper than traditional bank transfers or using credit cards.

- Multi-currency accounts You can create virtual accounts in more than 40 currencies, including euros (EUR), US dollars (USD), British pounds (GBP) and more. This is convenient for working with clients from different countries, as you avoid unnecessary conversion costs.

- Invoicing The platform allows you to create professional invoices with the cost of services in the desired currency. Customers can easily pay them by bank transfer or card.

- Wise’s real-world exchange rates use mid-market rates with no markups, which allows you to save on international transfers.

- Integration with accounting systems The service supports integration with tools such as Xero and QuickBooks, which simplifies financial reporting.

How to set up Wise Business to accept payments

- Account Registration Register on the Wise Business website by providing information about your business. The registration process includes verification of the company’s identity and documents.

- Adding currencies After registration, you can open a multi-currency account and customize it to meet the needs of your business.

- Invoicing Use the platform to create invoices by specifying the service description, cost, and currency. The invoice can be sent to the customer by email.

- Connecting a bank account To withdraw funds, link your bank account to the platform. Wise allows you to send money in 80+ countries.

Fees and withdrawal times

Wise Business charges:

- Fixed fee: for example, €0.50 per transfer.

- Percentage of the transfer amount: for most currencies, it varies from 0.35% to 1%.

Withdrawals to a bank account usually take anywhere from a few minutes to 1-2 business days.

Features of using Wise Business in Germany

Working with international payments in Germany has its own nuances. Wise Business helps you efficiently address issues related to tax accounting, local requirements, and customer convenience. Here are the key features:

1. SEPA Payment Support

SEPA (Single Euro Payments Area) is a standard for bank transfers in EU countries, which provides fast and convenient transactions in euros. Wise fully supports SEPA payments, which provides the following benefits:

- Fast Transfers: Funds are usually received within one business day.

- Low fees: Unlike traditional banks, Wise charges minimal fees for such transfers.

- Easy to use: There is no need to specify the IBAN manually – the system automatically checks and simplifies the sending process.

2. Tax Compliance

In Germany, all companies and freelancers are required to take tax aspects into account when invoicing. Wise provides features that make it easy to comply with local laws:

- VAT inclusion (Mehrwertsteuer): The tax rate (usually 19% or 7%) can be specified on the invoice and the VAT amount can be clearly stated. This is especially important for customers who are registered as legal entities.

- Export reports: The platform allows you to export transaction data for any period, which is convenient for filing a tax return or preparing for an audit.

- Support for local tax codes: Ability to specify a tax number (Steuernummer) or VAT ID (USt-IdNr) directly in the invoice template.

3. Work with clients in Germany

For customers in Germany, it is important to use popular and familiar payment methods. Wise offers convenient solutions:

- SEPA Direct Debit: This is an automatic debiting of funds from the customer’s bank account, which is convenient for subscription models or recurring payments.

- Interface localization: The system is available in German, and invoices and notifications can be sent in German, which increases customer confidence.

- Multi-currency support: Despite working in Germany, many freelancers work with clients from other countries. Wise allows you to invoice in EUR, GBP, USD, and many other currencies, which eliminates additional conversions for the client.

4. Accounting for currency transfers

Freelancers working with international clients often face the need to convert currencies. In Germany, it is important to:

- Indicate the exact amount in the client’s currency and its equivalent in EUR, if required for tax reporting.

- Use the mid-market rate to avoid additional costs. Wise automatically displays the conversion rate and fees, making the process transparent.

5. Automation of accounting

Bookkeeping in Germany can be a daunting process, especially for freelancers. Wise offers integrations with accounting systems such as DATEV, Xero, and QuickBooks, allowing you to:

- Automatically synchronize transactions.

- Mark paid invoices and track debts.

- Prepare data for your tax return without the need for manual accounting.

6. Integration with German banks

To withdraw funds or pay customers, you can link a German bank account to Wise. This guarantees:

- Fast withdrawals: Funds usually arrive within 1-2 business days.

- Easy IBAN linking: The platform supports all German banks, which simplifies the setup process.

7. Practical Help for Freelancers

Wise actively updates its knowledge base and provides specialized instructions for freelancers in Germany:

- Billing guidelines.

- Tips for managing multi-currency accounts.

- Information on tax regulations and reporting in Germany.

8. Reporting for Finanzenamt

Wise allows you to prepare all the necessary information for reporting to the German tax office (Finanzamt):

- Download all transactions for the year in a convenient format (CSV or PDF).

- Specify account IDs for easy sorting of income.

- Include currency conversion details if payments are received in different currencies.

Practical tips for working with Wise Business

- Multi-currency accounts: Use them to minimize currency conversion costs.

- Accounting automation: Integration with Xero and QuickBooks will speed up the financial accounting process.

- Testing the system: Before sending the first invoice to the client, test the functionality of the platform.

Annual Reporting

Annual reporting is an important part of a freelancer’s job in Germany. Reporting includes collecting all financial data for the year, filing a tax return, and meeting legal deadlines. For freelancers using the EÜR (Einnahmenüberschussrechnung), a simplified income and expense accounting system, proper preparation and submission of reports helps to avoid problems with the tax office.

1.1. Preparation of the Annual Report

The preparation of an annual report begins with the systematization of all financial documents and their correct accounting. It is important to collect and process:

- Earnings: All earnings earned for the year, including invoices you issued to customers and payments received.